Short-term insurance provides flexible, affordable protection for individuals and businesses facing unexpected events. The best plans cater to diverse needs, offer tailored coverage, clear terms, efficient claims processes, and excellent customer support. To select the right plan, assess unique needs, budget, duration, and accessibility of funds; compare providers; and understand the claims process. Proper documentation, organized materials, accurate form completion, and timely submission streamline claims handling for the best short-term insurance plans. Top plans offer clear guidance, multiple communication channels, and educational resources for a stress-free experience during unforeseen circumstances.

“Uncertainty is an inevitable part of life, and short-term insurance offers a vital safety net for navigating these unpredictable moments. This comprehensive guide dives into the intricacies of the claims process for short-term insurance policies, empowering individuals to make informed decisions about their coverage. From understanding the fundamentals of this type of insurance to selecting the best plans tailored to your needs, we provide essential insights. Learn key steps for filing claims seamlessly, avoid common pitfalls, and leverage customer support resources to ensure a smooth experience.”

- Understanding Short-Term Insurance: A Brief Overview

- Choosing the Best Short-Term Insurance Plan for Your Needs

- Key Steps in Navigating the Claims Process

- Documenting and Submitting Your Claim Effectively

- Common Challenges and How to Overcome Them

- Customer Support and Additional Resources

Understanding Short-Term Insurance: A Brief Overview

Short-term insurance is a crucial safety net for individuals and businesses facing unexpected events or financial setbacks. Unlike long-term policies that focus on comprehensive coverage over an extended period, short-term plans offer immediate protection for specific periods, typically ranging from a few months to a year. These plans are designed to cater to various needs, from covering unforeseen medical expenses to providing liability protection for small businesses.

The allure of the best short-term insurance plans lies in their flexibility and affordability. They allow individuals to access quality healthcare or business liability coverage without committing to long-term financial obligations. When choosing a plan, it’s essential to consider factors like coverage limits, deductibles, and exclusions to ensure it aligns with your immediate needs. With careful consideration, short-term insurance can be a valuable asset, offering peace of mind and financial security during uncertain times.

Choosing the Best Short-Term Insurance Plan for Your Needs

When considering short-term insurance, it’s crucial to evaluate your specific needs and circumstances to choose the best plan. Different policies cater to various scenarios, such as covering unexpected expenses during career transitions, providing income protection for temporary disabilities, or offering medical coverage for limited periods. Assessing your budget, duration of coverage required, and desired level of accessibility to funds is essential. Opting for a flexible plan that aligns with your short-term financial goals ensures you’re adequately protected without overspending on unnecessary features.

The best short-term insurance plans offer comprehensive benefits tailored to individual needs. They should provide clear terms and conditions, straightforward claims processes, and efficient customer support. Comparing different providers and their offerings is key to finding a plan that offers the right balance of protection and affordability. This involves examining factors like deductibles, coverage limits, and any exclusions or limitations to ensure the plan meets your requirements effectively.

Key Steps in Navigating the Claims Process

Navigating the claims process for short-term insurance can seem daunting, but understanding the key steps can help ensure a smoother experience. The first step is to review your policy documents carefully and identify the specific terms and conditions related to making a claim. This includes understanding the types of losses covered, deductibles, and any exclusions. Knowing these details from the start will save time and potential frustration later.

Next, gather all necessary information and documentation related to your loss or damage. This might include police reports, photographs, receipts for repairs or replacements, and medical records if applicable. Organize this documentation in a neat folder to easily provide to your insurance provider when filing a claim. Remember, clear communication with your insurer is vital; be prompt in reporting the incident and keep them updated throughout the process. By following these initial steps, you’ll be well-prepared to choose the best short-term insurance plans that suit your needs and ensure efficient claims handling.

Documenting and Submitting Your Claim Effectively

When navigating the claims process for short-term insurance, effective documentation and submission are key to ensuring a smooth experience. Start by gathering all relevant information and documents related to your claim, such as policy details, medical reports, and any evidence of loss or damage. Organize these materials in a clear, structured manner to avoid delays.

Utilize the resources provided by your insurance company, including online portals or dedicated customer service teams, to submit your claim efficiently. Double-check that all forms are completed accurately and that you’ve included all required documents. A well-documented and submitted claim expedites the evaluation process, helping you secure the benefits outlined in your best short-term insurance plans faster.

Common Challenges and How to Overcome Them

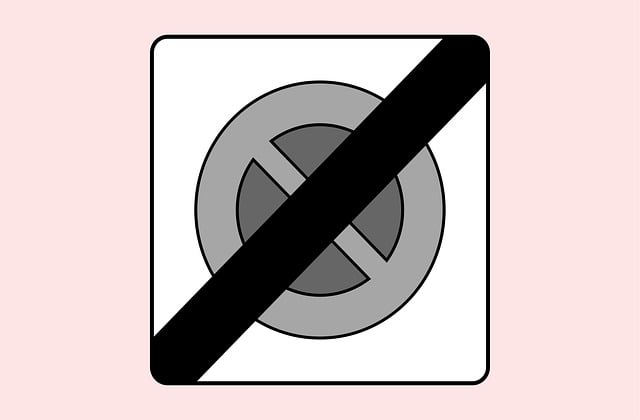

Navigating the claims process for short-term insurance can be challenging, but with the right preparation and understanding, policyholders can overcome these hurdles. One common issue is the lack of awareness about what’s covered and what isn’t. Before filing a claim, carefully review your policy documents to ensure you comprehend the terms and conditions. Many best short-term insurance plans provide clear outlines of coverage, exclusions, and the claims procedure, making it easier for policyholders to know what to expect.

Another challenge is timely filing. Delays in submitting a claim can lead to complications or even rejection. To avoid this, keep important documents organized and readily available, such as policy numbers, dates of loss, and contact information for all involved parties. Additionally, familiarize yourself with the insurance company’s claims submission process and deadlines to ensure your claim is filed promptly and accurately, increasing the chances of a smoother experience with your best short-term insurance plan.

Customer Support and Additional Resources

When navigating the claims process with short-term insurance, having access to excellent customer support is invaluable. The best short-term insurance plans prioritize efficient and responsive communication channels, ensuring policyholders can quickly report incidents or file claims. Many companies offer multiple support options, such as phone hotlines, email, and live chat, making it convenient for customers to reach out at their convenience. Prompt and knowledgeable assistance can significantly reduce the stress associated with unexpected events.

In addition to direct customer support, top-tier short-term insurance providers often provide a range of resources to educate policyholders and streamline the claims journey. These may include detailed guides on filing claims, step-by-step tutorials, and online portals where customers can track their claims progress. Such additional resources empower individuals to actively participate in managing their coverage, fostering a sense of control and confidence during challenging times.